Canada Mileage Reimbursement 2025

Canada Mileage Reimbursement 2025. 70 cents per km for the first 5000 km driven, up two cents from last year's rate 64 cents. The canada revenue agency has announced the new 2025 mileage rates:

How to calculate your mileage for work in canada. 64¢ per kilometre driven after that in the northwest territories, yukon, and nunavut, there is an additional 4¢ per kilometre allowed for travel.

In a significant move that will impact businesses across the nation, the department of finance canada has announced changes to the deductible mileage rates.

To calculate vehicle allowance amounts provided by employers using the cra mileage rate, multiply an employee’s total business kilometres driven during a given tax.

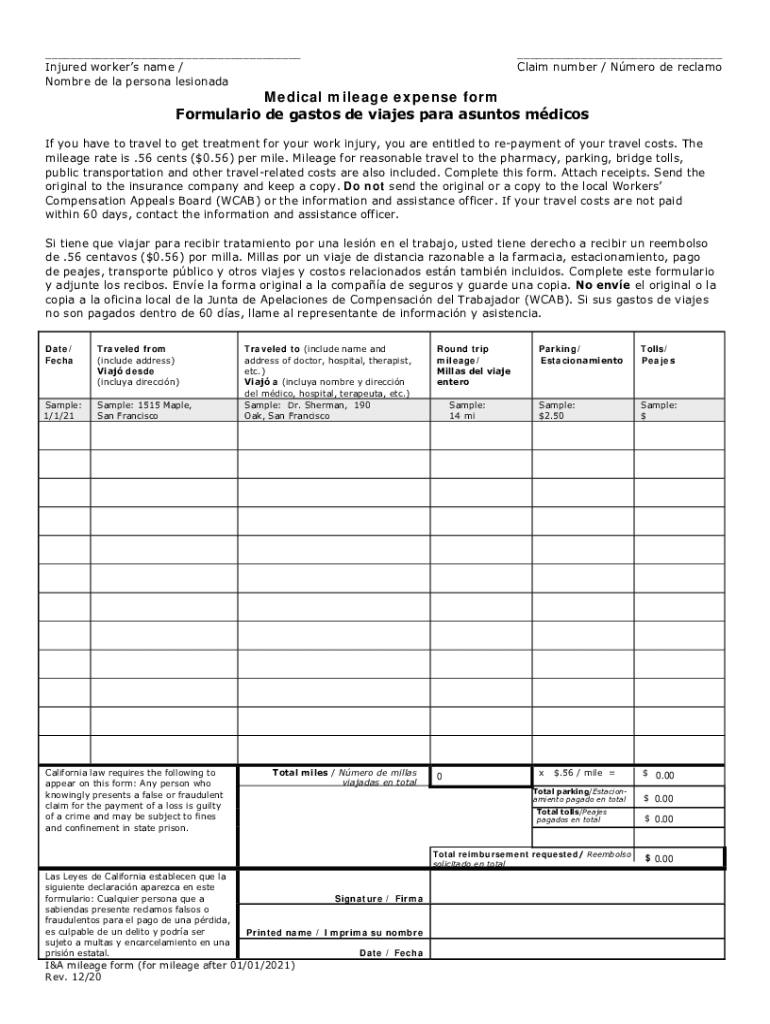

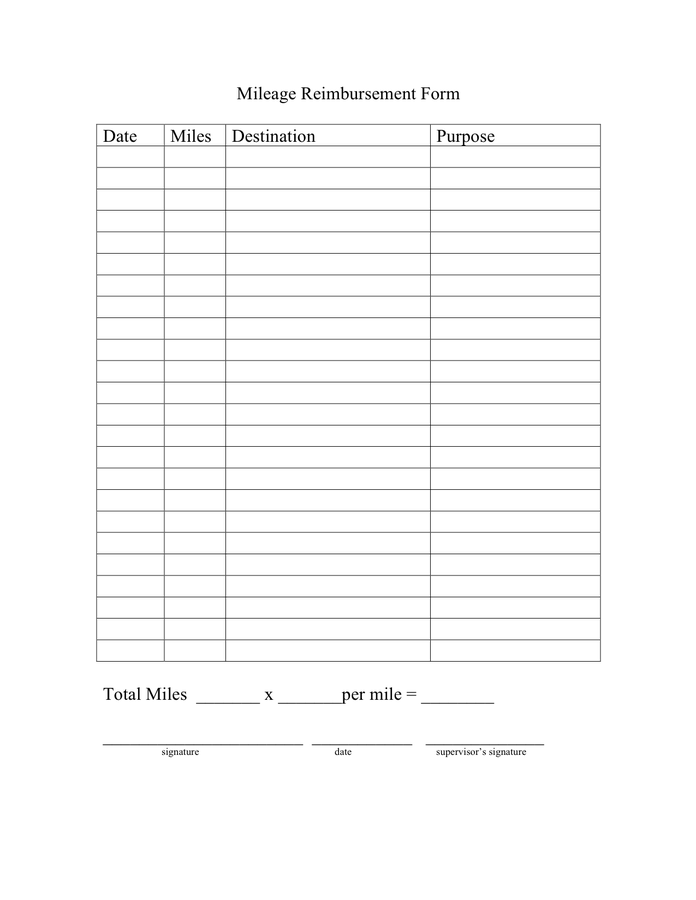

Free Mileage Reimbursement Form Download and Print!, The mileage reimbursement rate for 2025 will be adjusted to reflect the new rate determined by the department of finance canada annual publication which is a per. The rates for 2025 will be available on our website in 2025.

20202025 CA I&A mileage Form El formulario se puede rellenar en línea, The mileage reimbursement rate for 2025 will be adjusted to reflect the new rate determined by the department of finance canada annual publication which is a per. As of 2025, the cra will give back 70¢ per kilometre for the first 5,000 kilometres driven and 64¢ per kilometre after that.

Mileage Reimbursement Allowance in Canada CRA (2025) PiggyBank, If you are an employer, go to automobile and motor. If your employer does not offer.

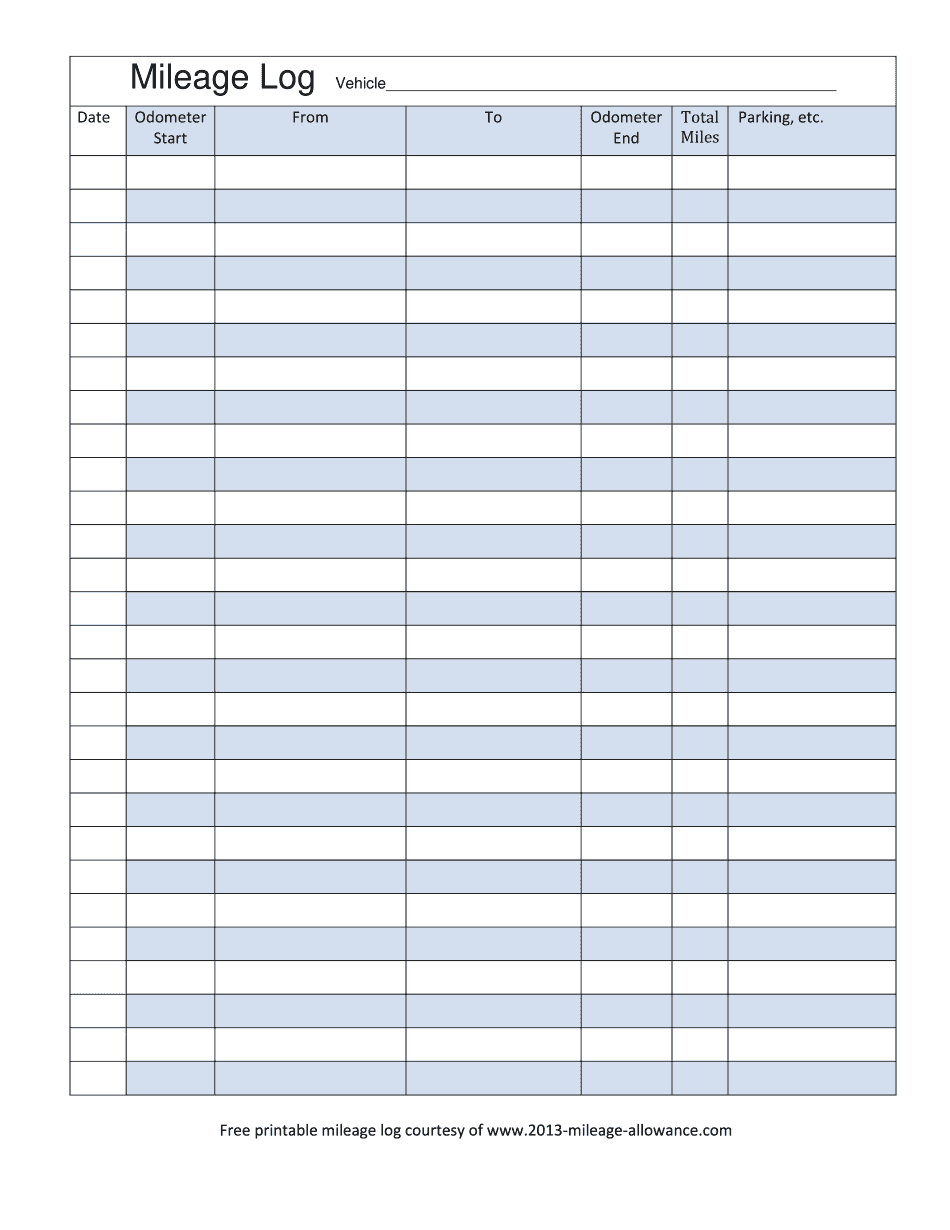

Mileage Allowance Free Printable Mileage Log 2025 Form Printable, If you are an employer, go to automobile and motor. Calculate mileage deductions from the cra.

2025 Mileage Log Fillable, Printable PDF & Forms Handypdf, For 2025, the department of finance canada made some notable changes to the automobile income tax deduction limits and mileage rates, with the initial mileage rate. The ceiling for capital cost allowances (cca) for class 10.1 passenger vehicles.

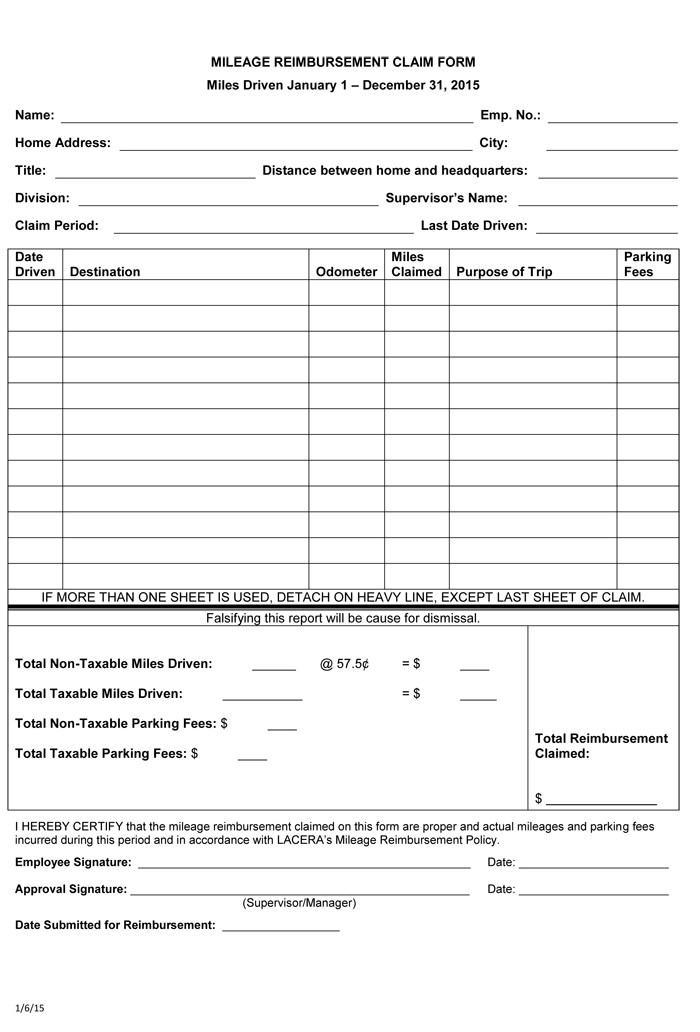

Example Mileage Reimbursement Form Printable Form, Templates and Letter, The ceiling for capital cost allowances (cca) for class 10.1 passenger vehicles. The automobile allowance rates for 2025 are:

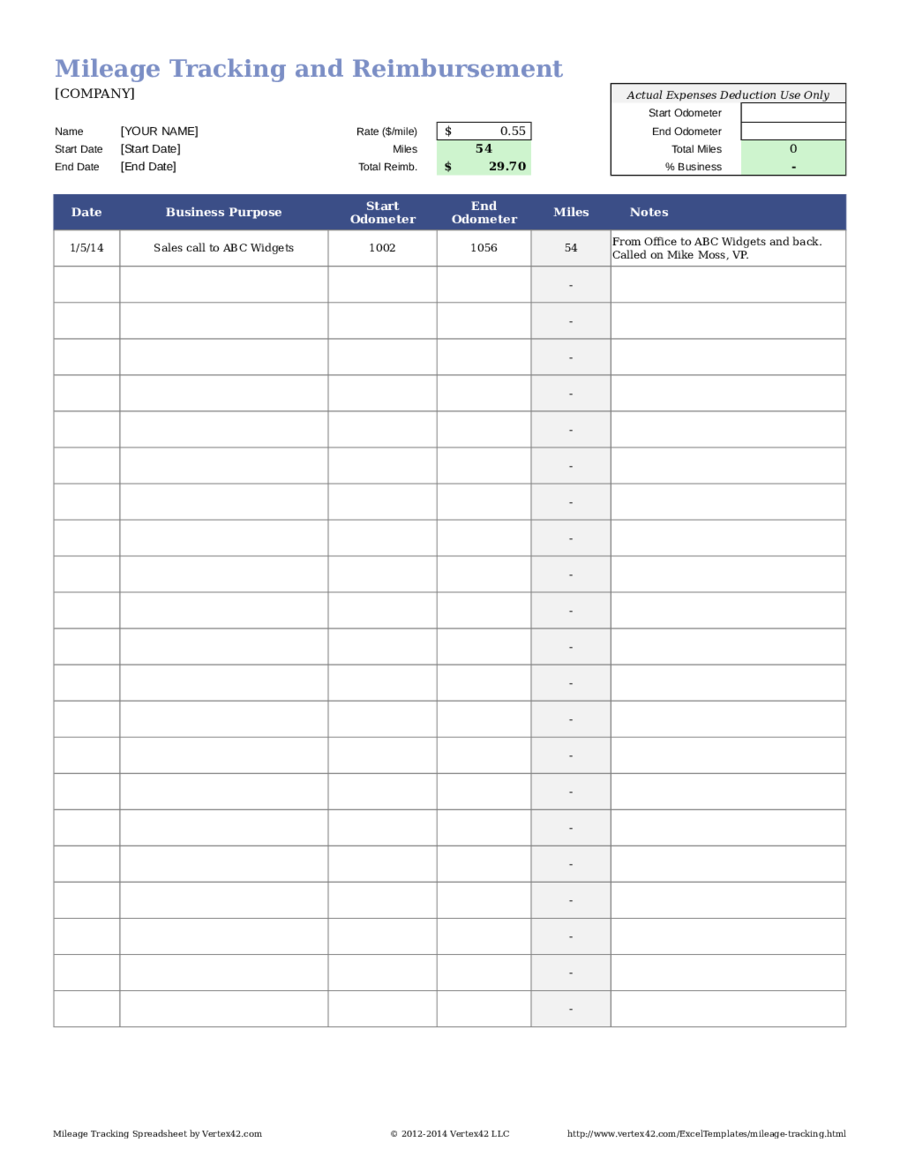

Free Mileage Reimbursement Forms & Templates (Word Excel), Calculate mileage deductions from the cra. If you drive in the northwest territories, yukon or.

Free Mileage Reimbursement Form Template PRINTABLE TEMPLATES, Meal and vehicle rates used to calculate travel expenses for 2025. How to calculate irs mileage reimbursement?

Handling the Headaches of Mileage Reimbursement SAP Concur Canada, The automobile allowance rates for 2025 are: The rates for 2025 will be available on our website in 2025.

Mileage Reimbursement IRS Mileage Rate 2025, To calculate vehicle allowance amounts provided by employers using the cra mileage rate, multiply an employee’s total business kilometres driven during a given tax. The mileage allowance is 70 cents for the first 5,000.

As of 2025, the cra will give back 70¢ per kilometre for the first 5,000 kilometres driven and 64¢ per kilometre after that.